The landscape of Swiss wealth management banks offers an intriguing glimpse into the composition and diversity practices within their Boards of Directors. 2022 data from our ZHAW Swiss WM study highlights structural dynamics, gender diversity, and evolving trends. This blog post delves into the key findings and highlights derived from our analysis of 67 Swiss wealth management banks, focusing on the composition of their Boards of Directors and the representation of women.

Board Composition: A Lean Approach

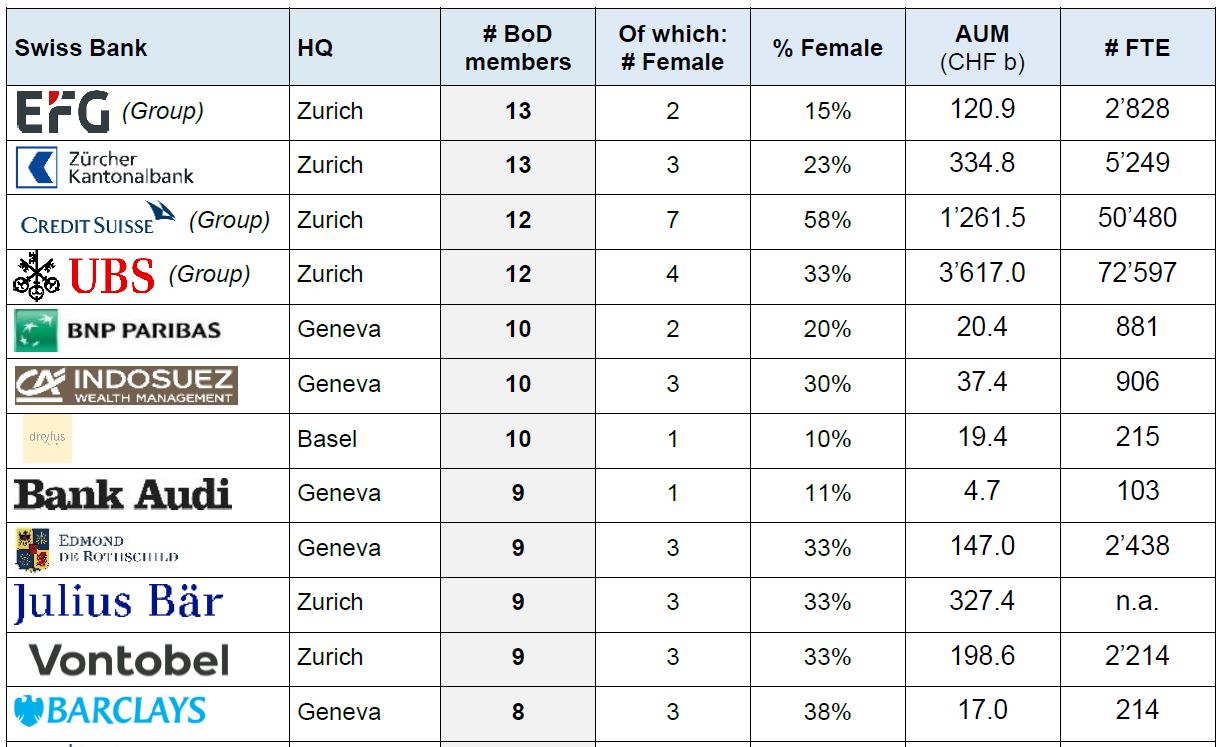

Swiss wealth management banks show a preference for a lean board structure, as evidenced by our data . The number of board members varies, with a minimum of 3 members in some banks and a maximum of 13 in others. Notably, a significant portion of the banks analyzed have between 5 to 6 board members. This trend suggests a strategic choice for efficiency and perhaps more effective governance, enabling these banks to navigate the complexities of wealth management with agility.

A few exceptions were noted in the data: Julius Bär and Safra Sarasin do not disclose board details in their annual reports, requiring information to be sourced from Switzerland’s public commercial register. Additionally, ZKB and GKB, as Cantonal Banks of public law, utilize a “Bankrat” in a similar capacity to a Board of Directors. Pictet differentiates itself with a Supervisory Board alongside a Board of Partners, with the former being considered for analyses.

Gender Diversity: Progress and Challenges

Gender diversity within the Boards of Directors of Swiss wealth management banks paints a mixed picture. In 2022, only 3 banks boasted a female majority on their boards – a notable increase from 0 in the previous year. Credit Suisse, Sociéte Générale, and Citibank emerged as leaders in this aspect, with female representation of 58%, 57%, and 50%, respectively. Despite these examples, the broader landscape reveals areas for further gender diversity.

A significant proportion, 34% of the banks analyzed, do not have any female board members, a slight improvement from 39% in 2021. Furthermore, 72% of the banks have only 1 female board member. This underrepresentation may underscore a persistent gender gap in the upper echelons of Swiss wealth management banks.

Key Takeaways

- Lean Board Structures: The preference for a lean board structure among Swiss wealth management banks suggests a focus on efficiency and potentially more effective decision-making processes.

- Progress in Gender Diversity: While there has been progress in gender diversity, with an increase in banks having a female majority on their boards, significant gaps appear to remain. A considerable number of banks still lack female representation at the board level.

- Need for Continued Efforts: The data highlights a need for continued efforts towards achieving broader gender diversity within the governance structures of Swiss wealth management banks. It likely reflects a broader industry trend and societal expectation for more inclusive leadership.

The findings from our study hopefully provide valuable insights into the governance and diversity practices within Swiss wealth management. As the industry evolves, it will be important for banks to embrace more inclusive governance structures that reflect the diversity of their clients, as well as society at large.