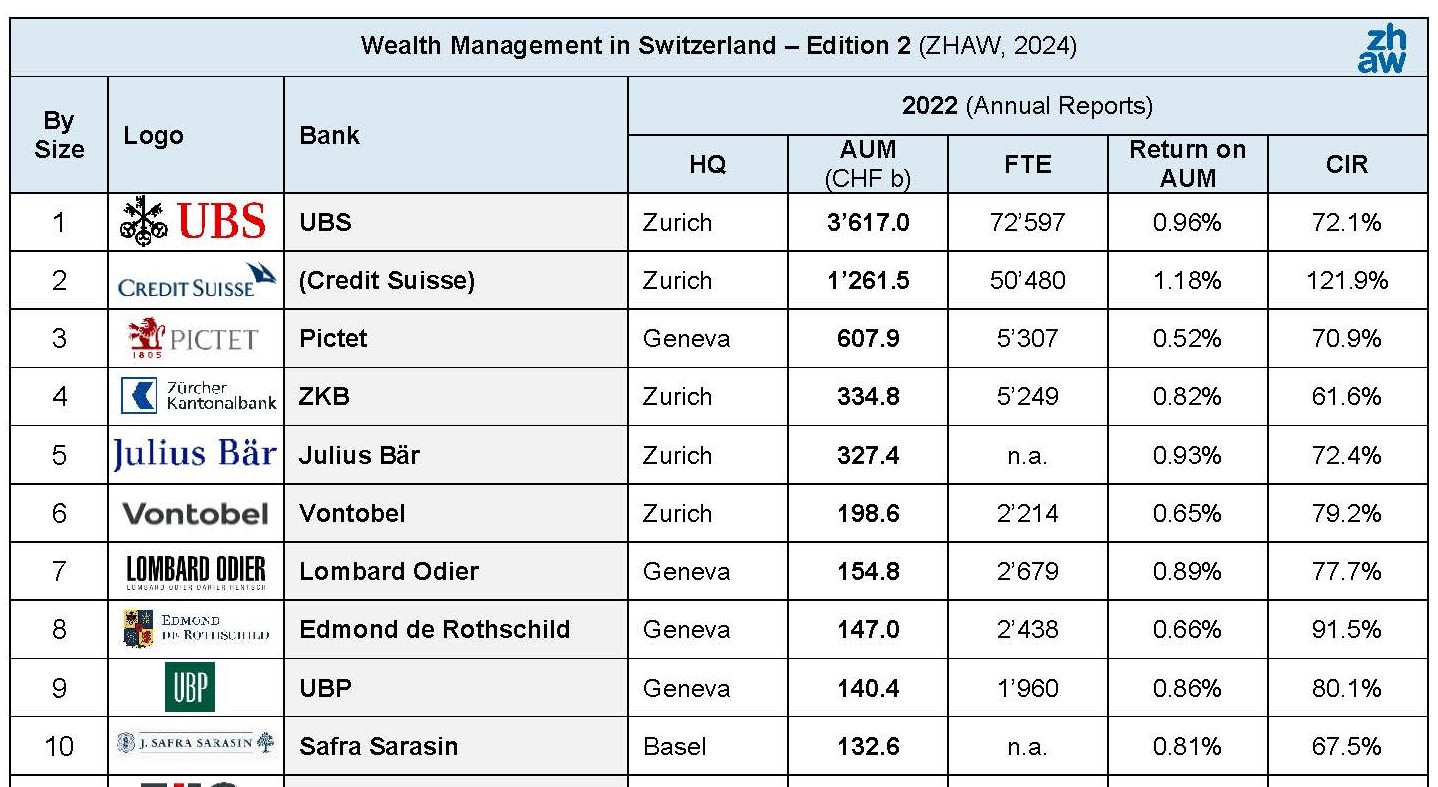

67 Swiss Wealth Management Banks, ranked by AUM

As the authors of the ZHAW 2024 study on Swiss Wealth Management Banks, we are proud to present a comprehensive industry analysis that evaluates the performance and standings of 67 Swiss Wealth Management Banks across various dimensions. We trust this study provides clients, industry professionals, and researchers with valuable insights.

In our study, based on the latest available 2022 annual reports, we found that UBS leads with an impressive Assets Under Management (AUM) of CHF 3’617b, followed by Credit Suisse (CHF 1’262b) in its final year of existence. These figures are a testament to the substantial trust placed by clients from around the world in Swiss wealth management banks, underscoring the sector’s global leadership and reliability.

We analyzed important KPIs such as Return on AUM and the Cost-Income Ratio (CIR) to gauge each bank’s profitability and efficiency. This is crucial for making informed decisions, be it for senior management focused on strategic positioning within the industry, or for prospects and clients looking for a suitable bank. For instance, ZKB demonstrated exemplary operational efficiency with a CIR of 61.6%, showcasing its effective cost management.

The findings from our study underscore the dynamic, resilient nature of the Swiss Wealth Management sector. They reflect the sector’s commitment to upholding the highest standards of service and performance, affirming Swiss wealth management banks’ position as leaders in global wealth management.

As Jonas Hefti and I reflect on the insights gleaned from our study, it becomes clear that the reputation of the Swiss wealth management sector for excellence is well-earned. The analyses we have provided equips stakeholders with the knowledge to navigate the complexities of wealth management services more effectively.

In conclusion, we hope that our ZHAW 2024 study on Swiss Wealth Management Banks is more than just an academic exercise; it is helpful resource with benchmarks of Swiss wealth management excellence. As the Swiss and global financial landscapes continue to evolve, we aim to closely accompany, document and predict future industry developments.