Digital transformation has significantly reshaped all banking sectors, transforming traditional banking practices into dynamic, technology-driven services. Social media’s integration into banking has been one of the more recent changes, offering new avenues for client engagement, marketing, and service delivery. For Swiss wealth management banks, known for their discretion and reliability, adapting to this digital shift has become crucial, especially with the emergence of a new generation of wealthy clients: the so-called NextGen.

The Transformative Influence of Social Media on Wealth Management

Digital transformation in wealth management involves adopting advanced technologies and re-imagining client experiences to stay competitive and meet evolving expectations. Social media platforms such as LinkedIn or YouTube have become important tools in this transformation, providing banks with the ability to engage clients more personally and effectively. Successful digital transformation requires a shift in organizational culture, emphasizing innovation, agility, and client-centricity.

A new article by Nicola Del Sarto et al. on digital banking involving six Italian retail banks highlights the significant impact of social media on digital transformation. These banks utilized social media to enhance client engagement, streamline operations, and foster a culture of innovation. The findings underscore the need for a new organizational culture focused on Millennials and Gen Z, proactive responses to FinTech challenges, and the integration of new financial instruments.

Key Strategies for Effective Social Media Integration for Wealth Management Banks

One of the key strategies to enhance client service is through real-time social media interactions. This approach enables wealth management banks to address inquiries and concerns promptly, providing a more personalized and immediate response. By building brand loyalty and trust through engaging and informative content tailored to clients’ individual needs, banks can strengthen their relationship with clients.

Financial innovation is another important aspect. Offering new financial products and services that cater to the digital-savvy wealthy clients can set banks apart from competitors. Utilizing social media for educational purposes may enhance clients’ financial literacy and understanding of complex products, making them feel more empowered and informed.

Proactive collaboration with FinTechs may also drive innovation. By adopting cutting-edge technologies and implementing robust cybersecurity measures to protect client data and ensure privacy, wealth management banks can stay ahead of the curve.

Servicing NextGen Wealthy Clients

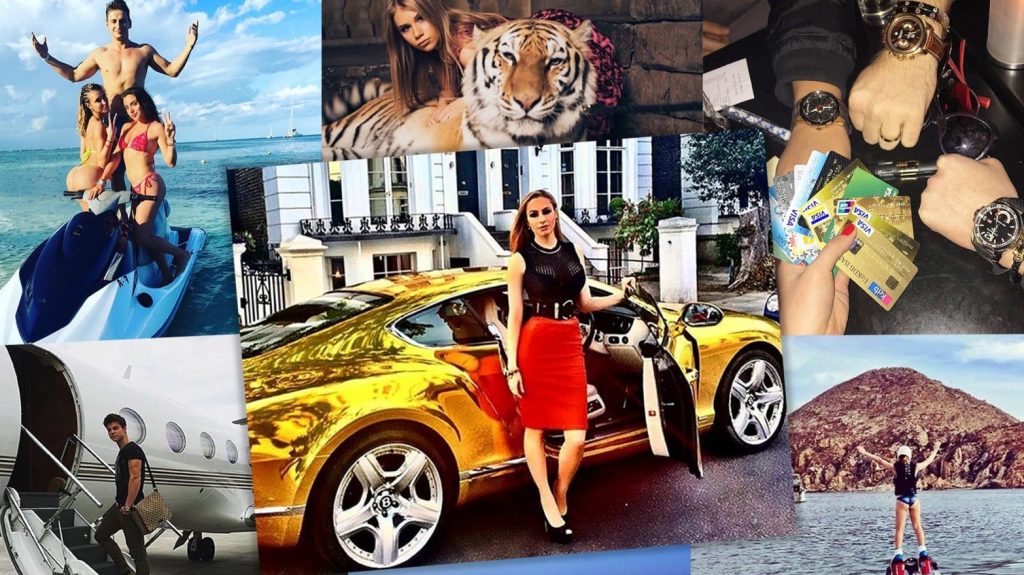

NextGen wealthy clients, primarily Millennials and Gen Z, have already and are going to transform the wealth management landscape with their distinct preferences and expectations. They often prioritize convenience, digital solutions, and personalized services. These generations are more likely to switch service providers if their needs are not met, making it essential for wealth management banks to offer seamless digital experiences.

NextGen wealthy clients expect swift and convenient digital services, such as the ability to manage their portfolios and conduct transactions via smartphones and other digital devices. They seek personalized financial advice and services accessible through digital channels. Real-time communication through social media platforms they regularly use in their everyday lives, along with interactive and personalized content that addresses their individual financial needs, is important.

For Swiss wealth management banks, meeting these expectations involves developing mobile-friendly solutions, i.e., creating platforms that allow NexGen clients to manage their wealth easily and securely from any location. Offering apps and tools that provide comprehensive financial overviews and personalized advice can enhance the client experience and ensure satisfaction.

Enhancing client engagement through social media is equally important. Swiss wealth management banks can use these platforms to keep clients informed about market trends, new financial products, and strategic advice. Providing a platform for clients to interact with relationship managers or investment consultants – and potentially even other clients – can foster a sense of community, further strengthening client relationships with the NextGen.

Adapting to the Digital Landscape

Swiss wealth management banks should therefore cultivate a digital-first culture, integrating social media into their core strategies. This involves training front office employees to leverage digital tools, fostering a culture of continuous innovation, and aligning organizational structures with digital goals. Leveraging social media for client engagement through real-time communication, targeted marketing, and financial education may enhance client experiences and build brand loyalty – even to seemingly “boring” or “unsexy” outfits like wealth management banks.

Offering innovative financial instruments such as AI-powered advisory tools for clients, digital wallets, and blockchain-based solutions may differentiate Swiss wealth management banks, also in the global competitive landscape. Collaborations with FinTechs may drive innovation and provide clients with advanced financial services. By combining the stability of traditional Swiss banking with the agility of FinTech, Swiss wealth management banks may offer comprehensive solutions to modern wealthy clients.

So What? How To Stay Relevant for the NextGen

The integration of social media and digital transformation in wealth management presents both challenges and attractive opportunities for Swiss wealth management banks. By embracing a digital-first culture, leveraging social media for client engagement, and adopting innovative financial instruments, Swiss wealth management banks may effectively meet the individual and diverse needs of NextGen wealthy clients.

By doing so, they may not only enhance client satisfaction, but also ensure their long-term competitiveness and relevance, in a wealth management landscape where a growing number of digital-first players may start targeting wealthy clients. The future of Swiss wealth management banks may therefore lie in the ability to combine their traditional – yes, sometimes conservative – banking strengths with the agility and innovation of digital technologies, ensuring that the needs of the NextGen are met with precision and excellence.

1 Kommentar